Banking M&A trends slow: What you need to know

Banking M&A trends are slowing due to increased regulatory scrutiny, competitive pressures on smaller banks, and a growing focus on technology integration, affecting how firms strategize for future mergers and acquisitions.

Banking M&A trends slow may not sound surprising given the economic climate. But what does it really mean for the financial industry? Let’s dive into the factors at play and uncover the broader implications for both large and small banks.

Current state of banking M&A

The current state of banking M&A reflects significant changes in the financial landscape. As various economic factors shift, banks are reevaluating their strategies for mergers and acquisitions. Understanding this dynamic can offer insights into future trends.

Recent Activity in Banking M&A

In recent years, the pace of banking M&A has been influenced by several factors. Many banks are seeking to expand their reach or enhance their technological capabilities. The recent decline in activity is noticeable. Initially, after the pandemic, there was a surge in transactions, but that momentum has since slowed.

Factors Influencing the Slowdown

- Increased regulatory scrutiny affecting potential deals

- Economic uncertainty leading to cautious approaches

- Challenges in identifying suitable merger partners

The impact of economic conditions cannot be understated. Economic uncertainty around interest rates and inflation is on the rise, shaping decision-making. Moreover, smaller banks may struggle to find effective partners amid these challenges. As a result, strategic planning is essential for these institutions to thrive.

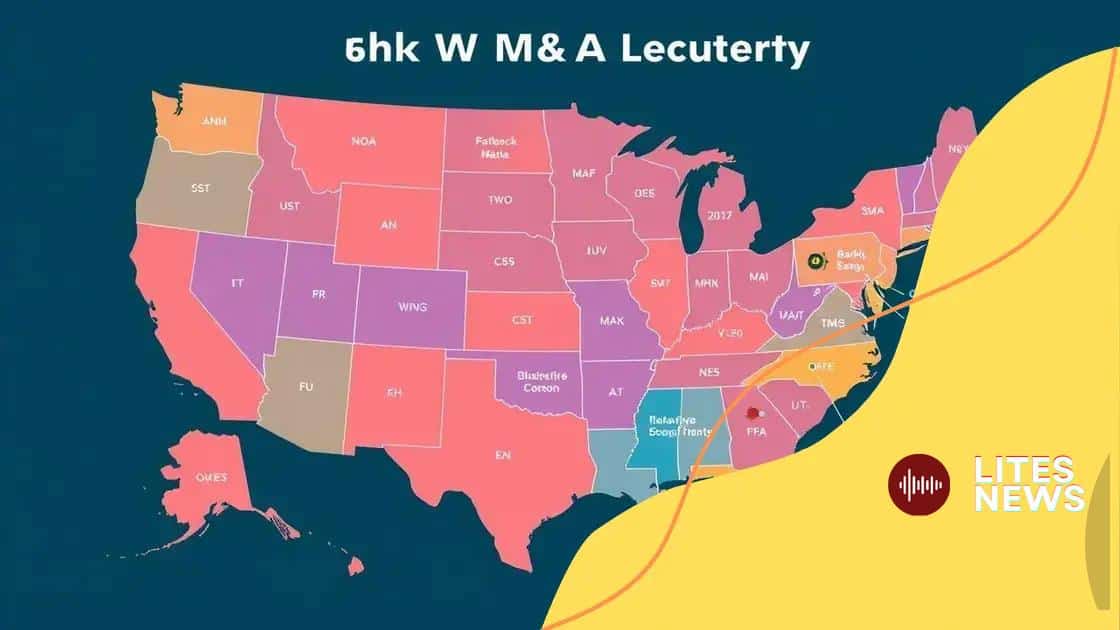

Regional Differences in M&A Activity

Interestingly, the slowdown is not uniform across the country. Regions with stronger economic prospects may still see significant activity. Banks in these areas often take on more risk to pursue growth opportunities, while others remain conservative in their approach.

In this nuanced environment, understanding these factors provides clarity on the current state of banking M&A. Each bank must carefully assess its position to navigate this evolving landscape effectively. Keeping an eye on market trends and adjusting strategies will be crucial moving forward.

Factors contributing to the slowdown

Several factors contributing to the slowdown in banking M&A reflect the current business landscape. As financial realities shift, the overall appetite for mergers and acquisitions has become more cautious. Understanding these factors is crucial for stakeholders looking to navigate this tricky terrain.

Regulatory Changes

One significant factor is the increase in regulatory scrutiny. Stronger regulations have emerged post-financial crisis, leading to longer approval times for mergers. This not only delays potential deals but also discourages banks from pursuing uncertain mergers.

Economic Uncertainty

The state of the economy plays a pivotal role. With inflation and changing interest rates, banks are hesitant to engage in risky acquisitions. This economic uncertainty shapes decision-making processes and can lead to a more conservative posture. As a result, many banks are choosing to hold off on deals until conditions improve.

- Concerns over consumer spending

- Fluctuations in asset valuations

- Unpredictable market movements

Additionally, competition for targeted acquisitions remains high. Many banks find it challenging to identify suitable partners that align with their strategic goals. If a potential partner is heavily sought after, this can inflate valuations, further complicating negotiations. Understanding these competitive dynamics can provide clarity for banks that hope to engage successfully in M&A activities.

Challenges with Integration

Integration challenges after a merger are another essential consideration. Many banks face difficulties in merging corporate cultures, aligning operations, and retaining key talent. These concerns can make banks wary about pursuing M&A, leading to further delays. When firms do enter into deals, ensuring a smooth transition becomes a critical objective that often impacts the success of the merger.

Ultimately, recognizing the multiple factors contributing to the slowdown can help banks formulate better strategies. By understanding the risk factors involved, institutions can make informed decisions that align with their long-term goals. As the banking landscape continues to evolve, these factors will remain at the forefront of M&A discussions.

Regional differences in M&A activity

Understanding the regional differences in M&A activity is essential for grasping how banking mergers and acquisitions function across different markets. These differences can significantly influence the strategies banks employ when considering potential mergers.

Variations Across Regions

Regions often experience M&A activity at different levels due to various economic and regulatory conditions. For example, some areas may show a robust appetite for mergers driven by a strong economy, while others may proceed with caution. This can be a result of local market dynamics, including competition and consumer demands.

- Stronger economic growth in specific states can lead to increased M&A interest.

- Local regulatory environments can either encourage or hinder merger activities.

- Financial institutions in urban areas might engage in more aggressive M&A strategies compared to rural counterparts.

The context surrounding each region plays a significant role in this activity. In metropolitan regions, banks are more inclined to pursue mergers to quickly gain market share and innovate services. Contrarily, smaller or rural banks may find it challenging to identify suitable partners, resulting in a more subdued M&A landscape.

Impact of Local Regulations

Regulatory frameworks can vastly differ from one region to another. Some areas may have policies that promote healthy competition and support mergers, while others implement stricter regulations that might slow down the process. For example, states with streamlined approval processes can see more mergers completed efficiently compared to those with lengthy review periods.

Furthermore, cultural factors also influence M&A activity. Regions that are open to business consolidation may see increased interest in larger deals, while areas with strong local identities may resist mergers, valuing community ties over corporate growth. These sentiments play a vital role in shaping whether the local banks pursue consolidation or remain independent.

The disparities in M&A activity across regions highlight the complexity of the banking landscape. As conditions adjust, banks must stay informed about these variations to tailor their strategies effectively. By understanding how geography impacts M&A, institutions can navigate challenges and seize opportunities based on their regional positioning.

Impact on smaller banks

The impact on smaller banks in the current M&A landscape is noteworthy. While larger institutions may pursue aggressive merger strategies, smaller banks often face unique challenges. These challenges can significantly shape their operations and long-term sustainability.

Market Pressures

Smaller banks are feeling the heat from larger competitors. As these bigger banks merge and grow, they can offer more services and better rates to customers. This puts pressure on smaller banks to either find partners or innovate their service offerings. If they do not adapt, they risk losing customers to larger institutions.

- Reduced market share due to competitive pricing from larger banks

- Challenges in maintaining a diverse range of financial products

- Increased marketing efforts needed to attract and retain customers

Additionally, the struggle for resources can stretch smaller banks thin. Without the capital and reach of larger banks, they may face constraints that limit their growth prospects. As a result, many smaller banks consider mergers as a way to enhance their competitive position.

Opportunities for Partnerships

Despite the pressures, there are also opportunities for smaller banks resulting from this environment. Collaborating with larger institutions can lead to improved technology access and better resources. Partnerships can help smaller banks enhance their services without losing their unique identities. When used strategically, mergers can provide the support necessary to thrive in a challenging market.

The delicate balance of maintaining customer relationships while pursuing necessary adaptations is vital for smaller banks. They must navigate these waters carefully, leveraging their local knowledge and community relationships while considering whether to partner or merge for growth.

Overall, the impact on smaller banks from the current M&A trends is multifaceted. While there are risks associated with competition, there are also pathways to strength through partnerships and strategic planning. Staying aware of industry movements enables smaller banks to make informed decisions that align with their long-term goals.

Future predictions for the market

Future predictions for the market in terms of banking M&A suggest a shift in strategy and approach from many financial institutions. As the economic landscape continues to evolve, banks must adapt to these changes to remain competitive and relevant.

Emerging Technologies

One key trend is the adoption of emerging technologies. Banks are increasingly looking to integrate technologies like artificial intelligence and blockchain into their operations. This integration will not only improve efficiency but also enhance customer experience. As smaller banks look to compete with larger institutions, adopting these innovations can be a critical differentiator.

Increased Collaboration

Another trend is the potential for increased collaboration within the industry. We may see more partnerships between banks and fintech companies. These collaborations allow banks to leverage the agility and innovation of fintechs while providing them with the stability and customer base of traditional banks. This partnership approach can create a win-win situation, leading to improved services for consumers.

- Increased focus on digital banking solutions

- Expansion of customer reach through strategic partnerships

- More competitive products tailored to customer needs

Additionally, regulatory changes will shape the future of banking M&A. Banks will need to stay ahead of these changes by being adaptable. Focusing on compliance while pursuing growth will be critical for maintaining market stability. Understanding the regulatory environment can help banks identify new opportunities and mitigate risks.

Market Consolidation

We can also expect to see continued consolidation within the market. As competition grows and market pressures increase, smaller banks may choose to merge or acquire others to enhance their market position. This consolidation will likely create fewer, but larger, banks that can offer a wider range of services. However, this trend raises questions about market diversity and customer choice.

Overall, the future predictions for the market indicate a shift towards more technology-driven and collaborative banking. Banks must carefully monitor these developments to adapt proactively. By embracing change and innovation, they can navigate potential challenges effectively and secure their place in the evolving financial landscape.

FAQ – Frequently Asked Questions about Banking M&A Trends

What are the current trends in banking mergers and acquisitions?

Current trends indicate a slowdown in M&A activity, increased regulatory scrutiny, and a shift towards technology integration.

How do smaller banks cope with competition from larger banks?

Smaller banks often seek partnerships and leverage technology to enhance their offerings and stay competitive.

What role does technology play in banking M&A?

Technology is crucial in modern M&A, helping banks improve efficiency and customer experience while facilitating better integration post-merger.

Why are regional differences important in M&A activity?

Regional differences affect market pressures, regulatory environments, and competition, all of which influence the success and strategy of M&A deals.